Update on December 31, 2024: Due to popular demand and continued expansion of service coverage for the SafePal banking gateway, the Zero fee campaign upgraded to a long-term waiver program to enable a growing user base to enjoy these important benefits. Any user who successfully opens a bank account in the SafePal app will enjoy zero on-ramp and deposit fees indefinitely while the waiver program is valid. SafePal reserves the right to amend any program details or rules at our sole discretion.

—————————————–

Dear SafePal community,

SafePal is excited to announce the launch of a Zero-fee campaign for its CeDeFi Banking gateway. Any user who successfully opens a bank account in the SafePal app will enjoy zero on-ramp and deposit fees indefinitely while the waiver program is valid.

Part I Open a bank account in SafePal and enjoy zero on/off-ramp fees

After completing account creation and activation, users will enjoy a waiver in the form of rebates for all on and off-ramp fees. (These rebates can be redeemed in the reward center, and require a total balance of 5 USDC before redemption is possible.)

Note: Rebates will only apply for routes where service fees are charged. For selected routes, the fees may directly be subsidized to 0. It might take a few minutes to refresh the rebates for further redemption. Please wait for a few minutes to view the latest rebates upon order completion.

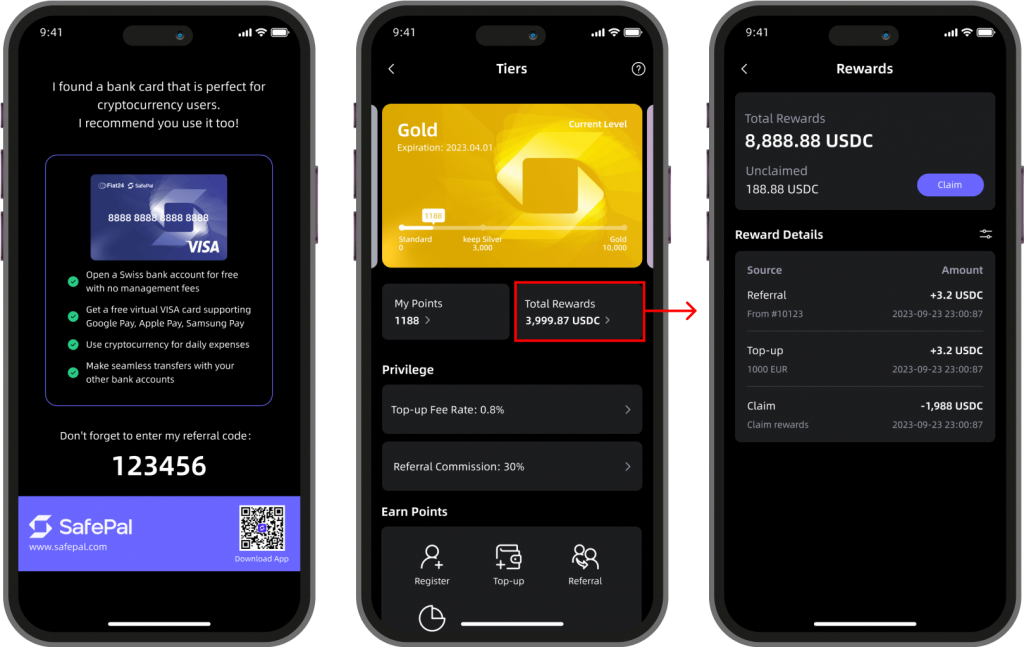

Part II Join the referral program to extend the 0-fee benefits

Users who successfully refer others to open an account with an invitation code ( where the referred person completes KYC) can extend the fee waiver period, with an additional 30-day extension for each person referred. (Ref

This can be stacked with the fee-waiver period of Part 1 and also the original referral system, whereby referrals are indefinite and commissions and rewards can be earned.

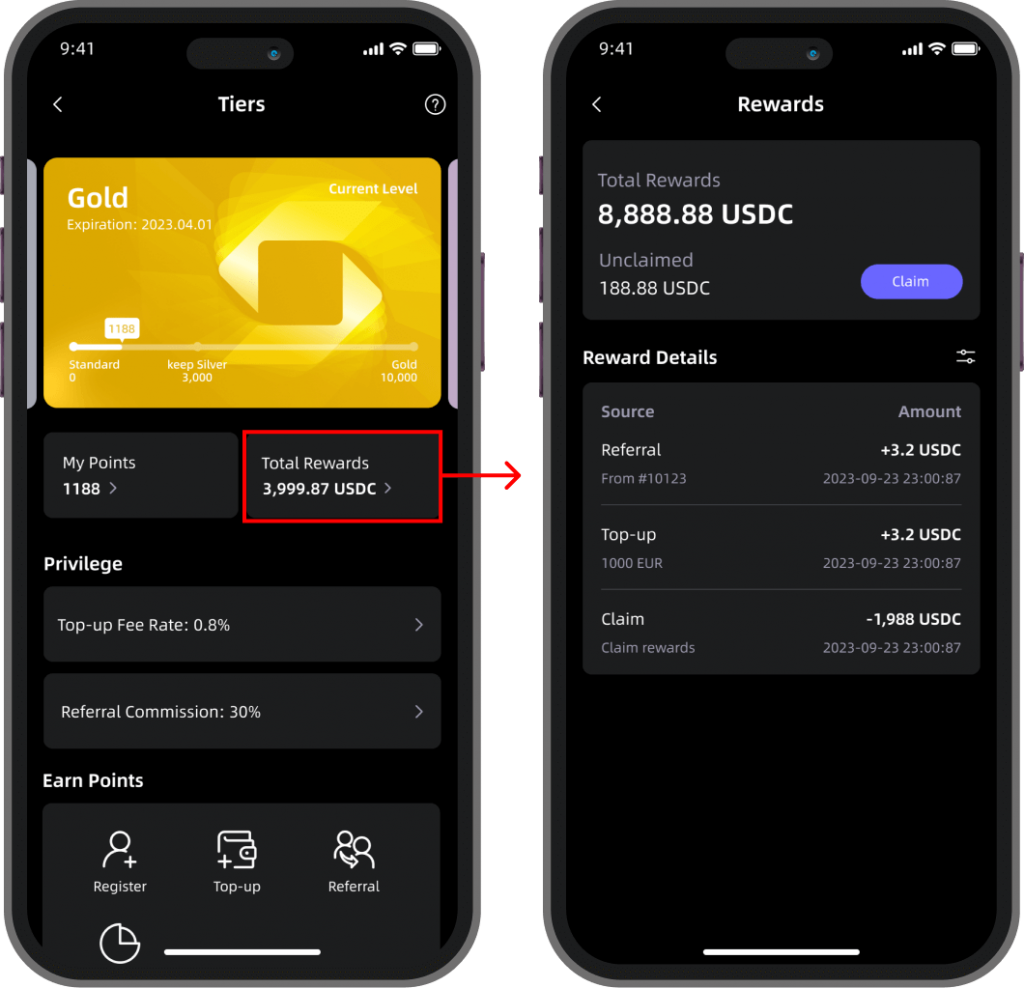

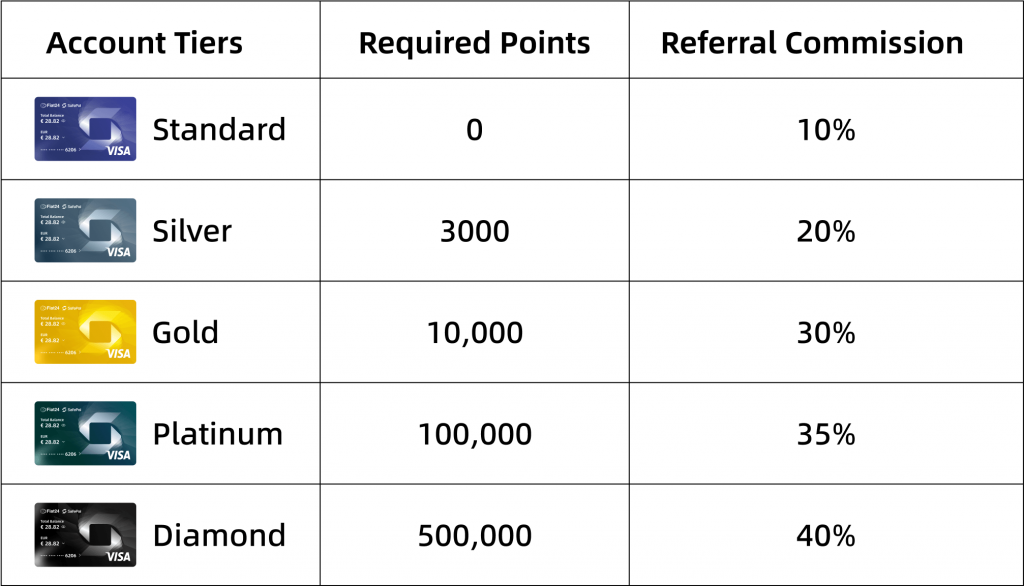

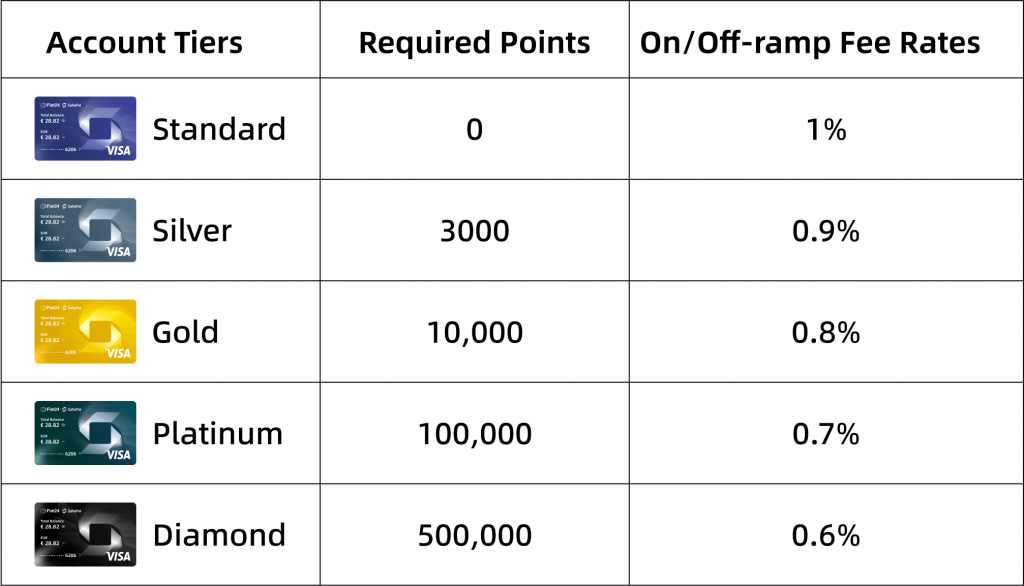

After referring others to use the bank service, referrers will earn referral commissions from the top-up fees of referred users indefinitely. (The percentage earned on referral commissions will depend on the account tiers of the referrers, as shown in the earlier section of this article.) The commission will also be sent to the ‘Total Rewards’ pool for corresponding accounts and can be withdrawn as well.

The major differences between the SafePal banking service and other crypto pre-paid cards

Currently, most cards in the crypto industry are generally just cards with pre-stored value, where the user needs to top-up the card balance for usage. In this case, the user’s funds are deposited in the card issuer’s institutional account, and the user does not have a separate bank account.

This is akin to the card issuer opening a corporate account in the bank, and then sending the user a corporate employee card. Such cards do not have a separate bank account and do not support transfer and withdrawal, and are only for expenditure. When the enterprise account encounters a problem, it will directly lead to all issued bank cards becoming invalid and unusable.

The SafePal banking gateway is different in the following way:

Upon successful registration and creation of their account, users have their individually owned separate compliant Swiss Bank Accounts (licensed by FINMA) where they can deposit USDC, USD, Euros and other fiat currencies. In addition, the bank account is currently equipped with a VISA virtual card, which can be bound to established payment providers such as Apple Pay, GooglePay, Paypal, Samsung Pay, and more for convenience usage and direct deduction from the bank account balance.

SafePal banking gateway also supports fiat currency deposits and withdrawals, as well as bank transfers in a compliant manner — It offers exchange between currencies such as USD, Euros, Swiss Francs, and RMB, and has the most competitive rates compared to other providers in various account tiers (More info about the tiers can be found here).

SafePal banking gateway is also safe and convenient to use together with SafePal swap, which supports 100+ blockchains and limitless trading pairs. SafePal will soon launch a multi-currency Mastercard, which will be equipped for each user who successfully opens an account by default. Bank accounts and cards are independent of each other, and will not affect the user’s bank account deposits and withdrawals .

In addition to all these essential features and functions, users can now participate the zero-fee campaign to enjoy free and seamless fiat on/off-ramps.

To get started, download the SafePal App here and click “Banking Gateway” in the DApp center “Featured” section to participate and learn more. Users can refer to the video tutorial here for guidance on the SafePal Banking Gateway, and learn more about SafePal Banking Gateway in the blog post here or product page here.

For more inquiries, users can also open a ticket here.

FAQ

1. Am I eligible for the SafePal banking gateway and Visa card?

Users can check the supported regions here, and stay tuned for updates on other regions.

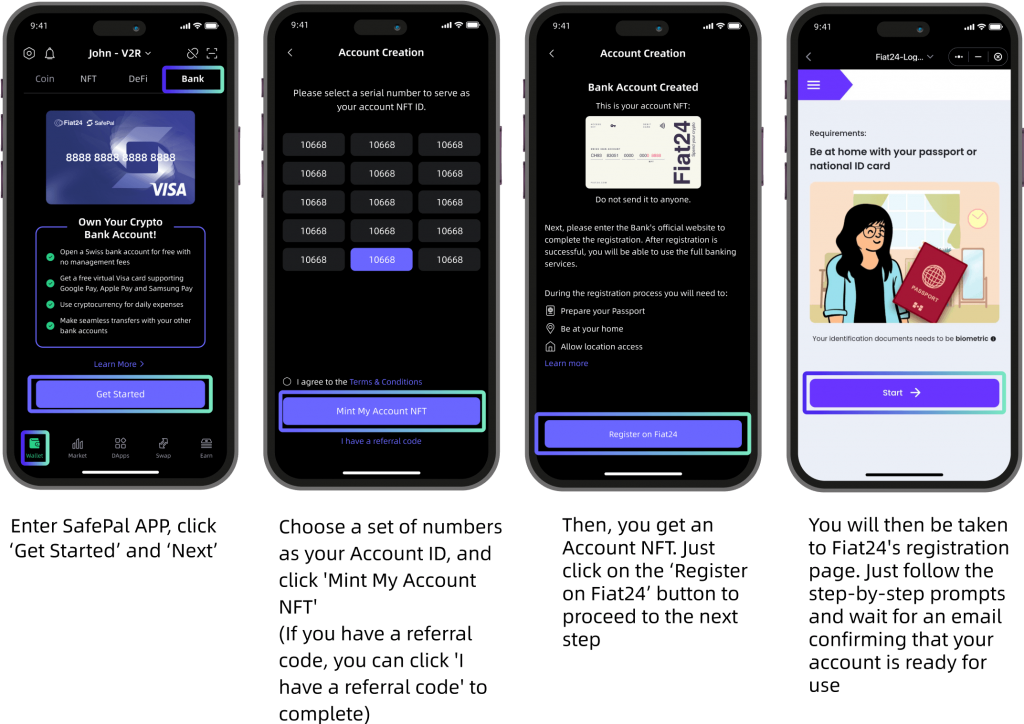

2. How can I apply for a bank account and Visa card?

Eligible users can open the SafePal wallet App and open a bank account under the Bank tab on the homepage. After completing the bank account registration, you will also receive a Safepal Visa card. Learn more about getting started here.

3. Are there any fees?

There are no account creation or management fees. The banking gateway and Visa card also offer the most competitive rates, with fiat transfer and deposit fees being as low as 0.6%. For more information, please visit our Pricing and Fee disclosures.

Full Disclaimer

Activity Rules

- SafePal reserves the right to disqualify participants who are deemed to be spammers or illegally bulk registered accounts, as well as activities that display attributes of exploitation or market manipulation.

- SafePal reserves the right to cancel or amend any activity or activity rules at our sole discretion.

Not Investment Advice

- This activity does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the article’s content as such. SafePal does not recommend that any cryptocurrency should be bought, sold, or held by you.

- Cryptocurrency investment is subject to high market risks. Please invest cautiously. SafePal will not be responsible for any investment losses. SafePal will not be liable whatsoever for any direct or consequential loss arising from the participation in its activities.

- Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Non-Endorsement

- The appearance of a third party on SafePal and its activities does not constitute an endorsement, guarantee, warranty, or recommendation by SafePal.

- Do conduct your own due diligence before deciding to invest in any third-party projects or use any third-party services.

About SafePal

Founded in 2018, SafePal is a comprehensive crypto wallet suite backed by industry leaders such as Animoca Brands, Binance and Superscrypt. SafePal empowers users to own their crypto adventure by accessing opportunities securely in the decentralized world via its hardware wallet, mobile app, and browser extension wallet solutions.

The SafePal platform serves over 16 million users globally across 200+ regions and countries, supporting 15 languages, 100+ blockchains with their tokens and NFTs. It also encompasses crypto asset management solutions like cross-chain swapping, trading and yielding tools, and even a CeDeFi banking gateway and Visa card for users.

SFP is a decentralized BEP-20 and ERC-20 utility token serving as the growth engine of the SafePal ecosystem and can be used to purchase SafePal products at a discount, converted seamlessly to gas across chains in the app, in addition to rewarding token holders and education programs.

Stay informed about SafePal here

About Fiat24

Fiat24 is a financial institution, regulated and licensed in Switzerland. Offering a suite of financial services through their dApp, Fiat24 clients get access to Swiss offshore cash accounts directly on the blockchain, allowing them to do top-ups via both crypto and bank wire through their Swiss IBAN, as well as do instantaneous currency exchanges, and spend via the Fiat24 Visa debit card.

Fiat24 is backed by FenBuShi Capital, Hashkey Capital, Kucoin Venture, Huobi Venture, IDG, Red Point, and serves thousands of users through strategic partnerships, with intentions to expand their services across various regions worldwide.