Dear SafePal community,

2024 has ushered in more mainstream attention with the approval of the Bitcoin ETFs. Regardless of market movements, the team at SafePal continues to focus on building products, developing features, and improving our offerings to better meet the needs of our users.

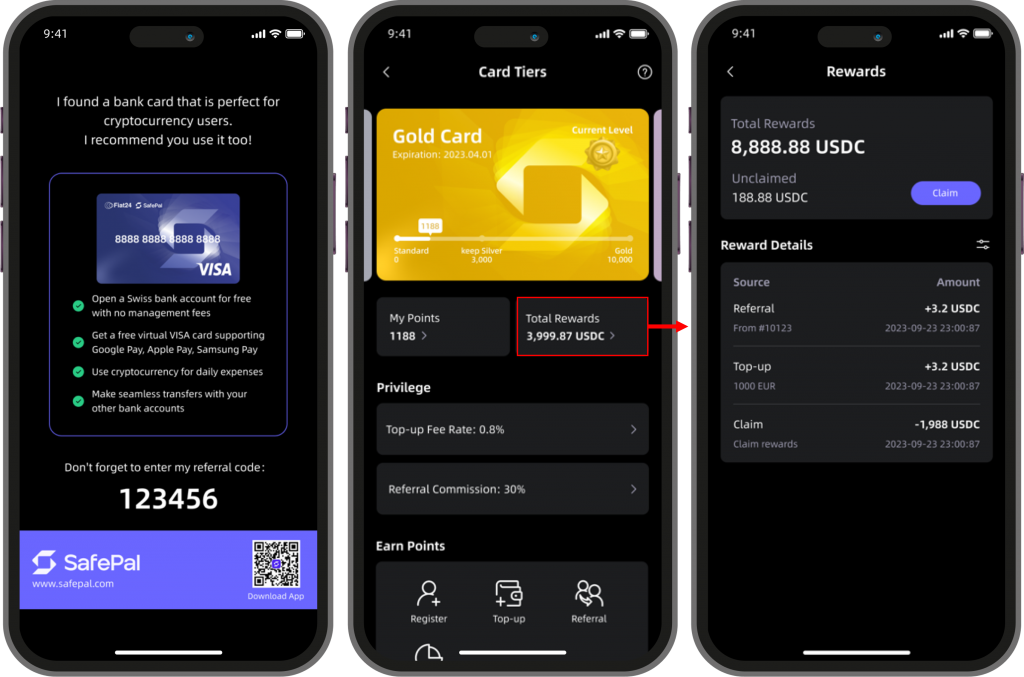

Accessibility has been a constant hurdle for crypto usage, and SafePal has consistently been looking to improve this as a gateway for crypto adoption. As part of these efforts, SafePal is excited to announce a strategic investment in Swiss bank Fiat24, and the launch of an in-app banking gateway and linked virtual crypto Visa card! This new service offering will pave the way to onboard more users into Web3 and accelerate the bridging of crypto to real-world utilities.

In accordance with banking laws by the Swiss Financial Market Supervisory Authority (FINMA), registration data for the service offering are stored separately and only accessible by relevant departments of Fiat24. The cash accounts are also operated separately by Fiat24, maintaining the decentralization and anonymity offered in the SafePal non-custodial wallet suite.

The banking gateway and Visa card will be rolled out first to selected regions in Europe before extending to the entire continent, and other countries (excluding the USA and US-sanctioned nations). The list of supported countries/regions for the service will be consistently updated and can be viewed here.

SafePal and Fiat24 also plan to roll out Mastercard services in Q3 this year as part of a global expansion, meaning users around the world will also be able to experience crypto-friendly living.

Product Highlights for SafePal Banking Gateway and Visa Card:

- No annual fees: Eligible users can open individually owned and compliant Swiss bank accounts under their name for free with no account creation or annual management fees

- Truly crypto-friendly: Users will be able to utilize cryptocurrency for daily expenses, and make seamless transfers with their other bank accounts compliantly — eliminating the excessive scrutiny and restrictions of traditional bank accounts while improving accessibility to on and off-ramps

- Spend crypto with ease: The virtual Visa cards support 3rd payment party platforms like Paypal, Google Pay, Apple Pay and Samsung Pay for smooth and seamless payments

- On-chain and transparent: After creating the bank accounts in the SafePal mobile wallet, the credentials are minted as an NFT on Arbitrum (an Ethereum Layer 2 solution), and all related transactions will be broadcast on-chain, providing a transparent, immutable ledger for users.

- Additional $SFP utilities: $SFP is knitted into the core product design, with staking for the decentralized utility token providing privileges and benefits

- Reliability and stability: USDC is the default deposit cryptocurrency to provide stability and safeguard card owners from market volatility. Users can swap their crypto with SafePal across 40+ blockchains into USDC on Arbitrum to be deposited into their bank accounts in the mobile wallet, to be stored as $USD, $EUR, and $CHF for various transactions and expenses.

Download SafePal App and learn how to open a bank account here.

Introducing Points, Account Tiers and Privileges

SafePal banking gateway account holders can earn points by performing various tasks to unlock additional benefits and privileges, like referral commissions and better top-up fee rates.The account tiers and corresponding privileges will automatically be activated once the point criteria is met.

On the 1st of each month, account tiers for each user will be assessed and determined by the total points earned in the previous 3 months. After the account tier assessment on the 1st of each month, points earned more than 2 months ago will be reset to zero.

For example, on April 1st, the total points earned from January to March will be calculated. If the points reach 3000, your account tier for April will be Silver. After the tier assessment on April 1st, the points for January will be reset to zero, while the points for February and March will be retained.

The following are different ways to boost the points for account tiers and their respective calculation mechanisms:

1) Account Top Up

The top-up fee discount is implemented through a rebate mechanism. For example, Silver tier users will still pay the standard 1% rate when depositing, and will get the 0.1% rebate once the top-up is complete. The fee rebates will be sent to the ‘Total Rewards’ pool for corresponding user accounts and can be withdrawn.

2) Referral Commissions

After referring others to use the bank service, referrers will earn referral commissions from the top-up fees of referred users indefinitely. The percentage earned on referral commissions will depend on the account tiers of the referrers, as shown in the account tier introduction in the earlier section of this article.The commission will also be sent to the ‘Total Rewards’ pool for corresponding accounts and can be withdrawn as well.

Here are the terms and conditions to qualify for a successful referral:

1. Referred users need to enter the invitation code within 7 days of the account being opened

2. Referred users must top up their account balance with a minimum accumulated amount of 100 USDC within 30 days of opening the account

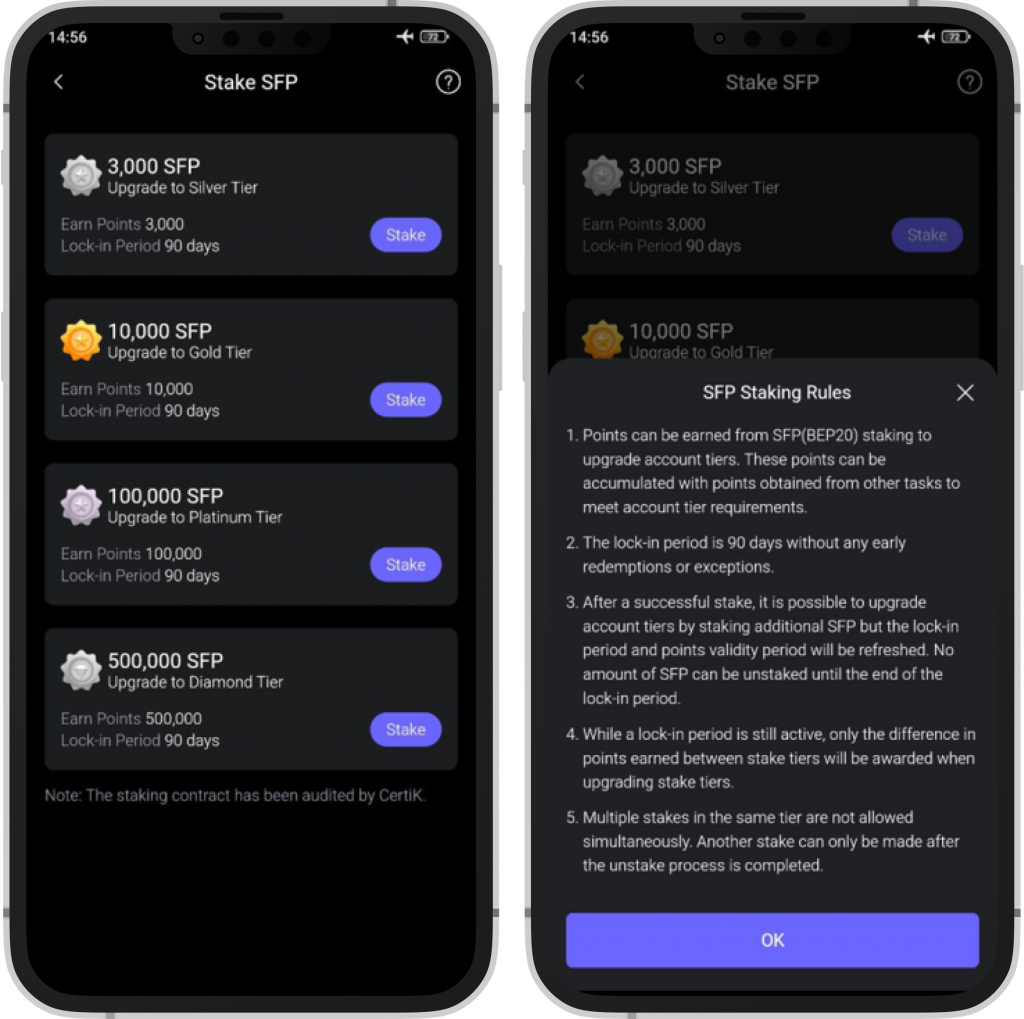

3) Stake $SFP

While $SFP can already be used to purchase SafePal products at a discount, be swapped for gas across chains, used to boost yield for staking in the SafePal earn section, and participate in exclusive giftbox events — the launch of the banking gateway and Visa card brings even more utility to the table than before.

By staking $SFP, account holders are able to boost the points on a 1:1 ratio. The lock-in period is 90 days without any early redemptions. After a successful stake, account holders can stake additional $SFP, and the lock-in period will be refreshed based on the latest staking date.

SafePal has always taken a practical and grounded approach towards the building of its products, and the development of $SFP with transparent tokenomics and whitepaper. With the further addition of staking utility to earn points to unlock higher tiers and benefits for users of the banking gateway and Visa card, the real world utility for $SFP is further amplified.

Step into the Web3-empowered Future

From today, eligible users are able to see a ‘Bank’ tab in the SafePal App after updating to V4.5.0 and above. After the successful account setup, all account details can be viewed from the Bank tab.

For the list of eligible countries and regions for the banking gateway and card services, please visit this link. For any further product guidelines and assistance, feel free to visit our HelpCenter or approach our customer support team.

The SafePal team will continue to work hard to deliver the best products and services to empower users on their crypto and Web3 adventure, and is thrilled to serve a key role as a gateway to onboard and retain users.

Much appreciation and thanks for the support from our users, stay tuned for even more updates and improvements in 2024!

About SafePal:

Founded in 2018, SafePal is a comprehensive crypto wallet suite providing hardware wallet, mobile app, and browser extension wallet solutions. As a non-custodial wallet suite, SafePal aims to allow users to own their crypto adventure, by empowering them to access opportunities securely in the decentralized world.

The SafePal platform is backed by industry leaders Binance Labs, Animoca Brands, and SuperScrypt; serving over 10 million users globally and supporting 15 languages, 100+ blockchains with their fungible and non-fungible tokens. It also encompasses crypto asset management solutions like cross-chain swapping, trading and yielding tools for users.

SFP is a decentralized BEP-20 and ERC-20 utility token serving as the growth engine of the SafePal ecosystem, and can be used to purchase SafePal products at a discount, converted seamlessly to gas across chains in the app, in addition to rewarding token holders and education programs.

Stay informed about SafePal here

About Fiat24:

Fiat24 is a financial institution, regulated and licensed in Switzerland. Offering a suite of financial services through their dApp, Fiat24 clients get access to Swiss offshore cash accounts directly on the blockchain, allowing them to do top-ups via both crypto and bank wire through their Swiss IBAN, as well as do instantaneous currency exchanges, and spend via the Fiat24 Visa debit card.

Fiat24 is backed by FenBuShi Capital, Hashkey Capital, Kucoin Venture, Huobi Venture, IDG, Red Point, and serves thousands of users through strategic partnerships, with intentions to expand their services across various regions worldwide.